Background and objectives

As a consequence of growing globalization and the increase in cross-border activities of many companies, international base erosion and profit shifting (BEPS) has become a significant problem for governments all over the world, costing countries an estimated USD 100-240 billion in lost revenue annually. Due to its global nature, this problem requires coordinated international solutions. Countries have collaborated to address BEPS through a series of measures, primarily under the OECD/G20 BEPS project. However, research indicates that many countries, particularly developing countries, face substantial challenges in adopting and implementing BEPS recommendations.

Therefore, German Development Cooperation commissioned the International Bureau of Fiscal Documentation (IBFD) to develop the BEPS Assessment Tool (B.A.T.) The objective of the tool is to support countries with limited capacities in scrutinizing the capability of their tax system to effectively deal with BEPS issues considered relevant for developing countries’ domestic resource mobilization and sustainable development. Based on the assessment of strengths and weaknesses, the B.A.T. provides suggestions for potential priorities for specific measures and capacity-building activities to tackle international tax avoidance.

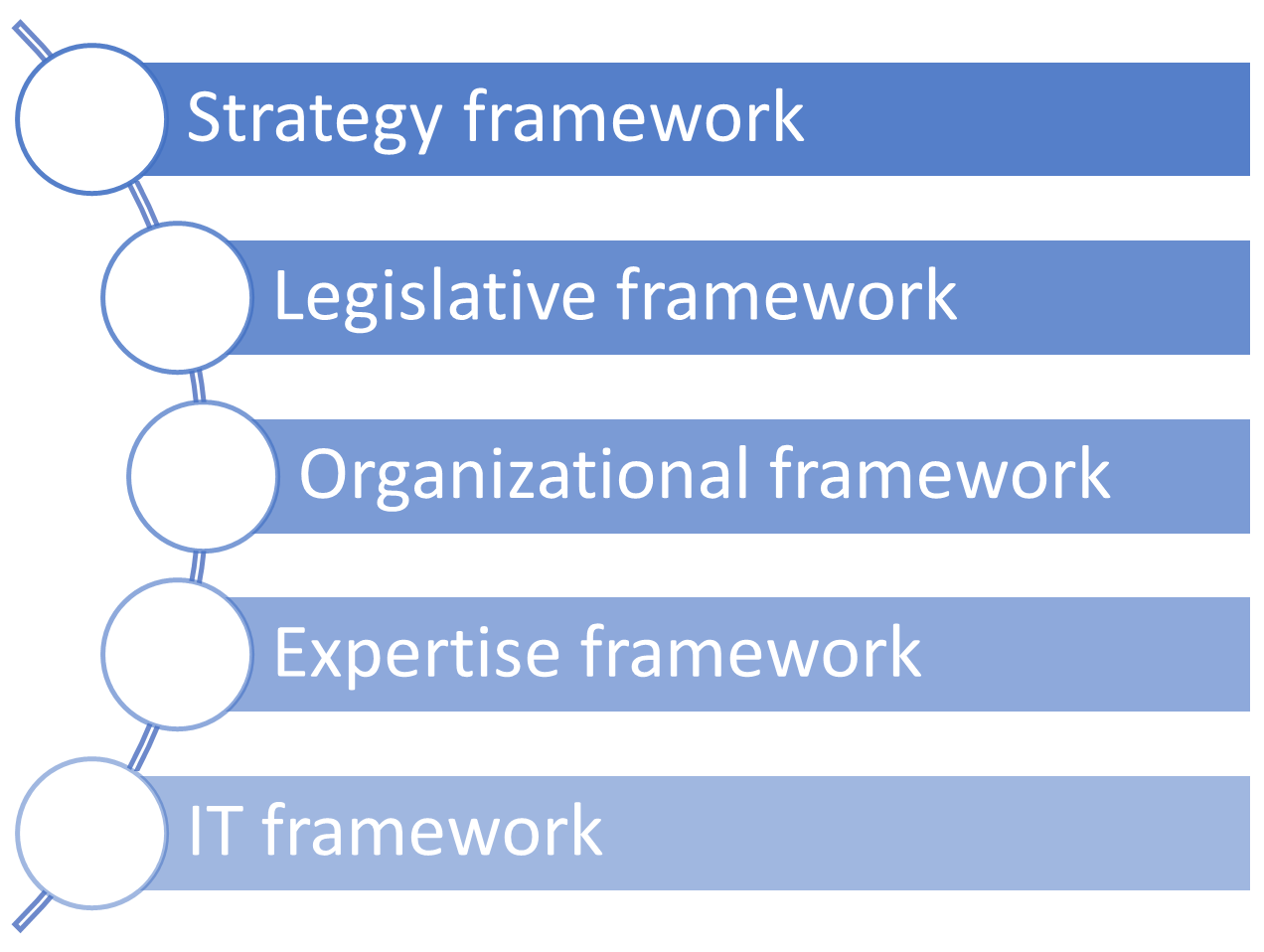

What does the B.A.T. assess?

The B.A.T. assesses challenges five key areas:

Within the assessment, both selected OECD/G20 BEPS Actions and other base erosion and profit shifting issues, as well as other measures considered relevant for developing countries, are examined.

How it works

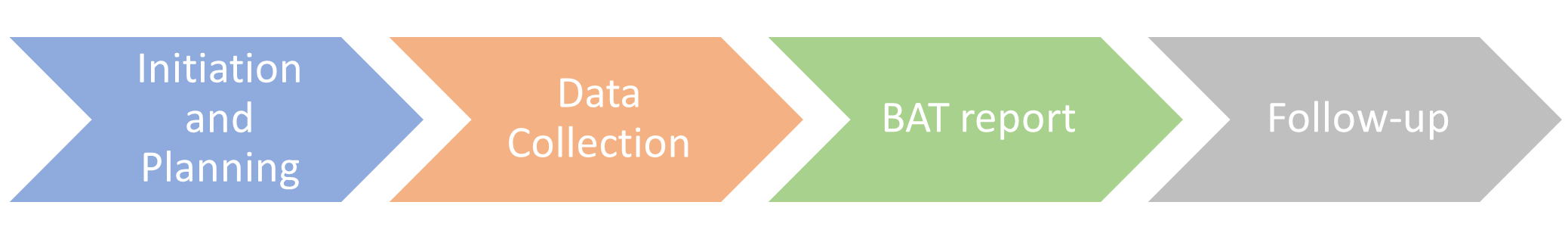

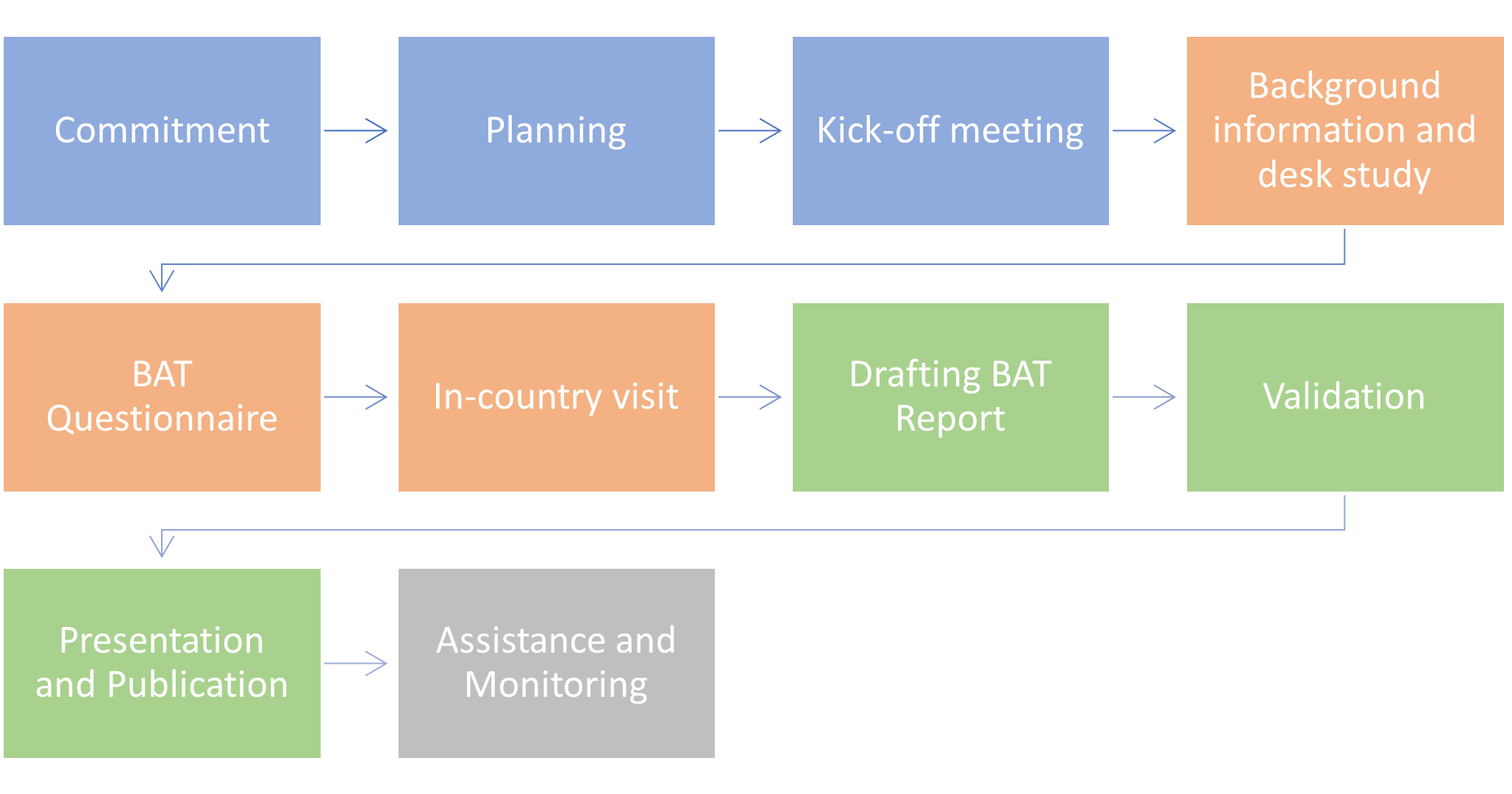

The B.A.T. is initiated upon request by the tax authorities of a country. The process comprises four phases, which are divided into ten steps, as illustrated below, and are conducted by a qualified assessment team.

It is a comprehensive evaluation process involving desk research, a detailed questionnaire, and in-country interviews. The five key areas are assessed on the basis of 46 performance indicators, which are measured based on specific scoring criteria. A four-point A-D scale is used to score each performance indicator, referencing international best practices.

The process culminates in a robust report, identifying a country’s progress in combating BEPS and areas for improvement. It includes recommendations on feasible measures that may be undertaken by the tax authorities to deal with BEPS and a priority-setting to implement these measures. It also aims to suggest specific actions that could be undertaken to start implementing these measures and to identify needs and possible assistance for capacity-building to address these needs.

For more information on the B.A.T., the process and the methodology, check out the B.A.T. manual and our FAQ.